Hybridge® SBA Loan

The Fastest, Easiest SBA Process on the Market

Spend less time waiting and more time growing with fast and frictionless financing.

Let's Get Started

What Do You Need to Qualify?

2+ Years in Business

$500,000 in Annual Gross Sales

685+ FICO Score

What is a Hybridge® SBA Loan?

What Are The Benefits of NBC’s Hybridge® SBA Loan?

The Fastest & Easiest SBA Process on the Market

How Can You Use Your Hybridge® SBA Loan?

Why Choose National Business Capital for a Hybridge® SBA Loan?

What is a Hybridge® SBA Loan?

What is a Hybridge® SBA Loan?

The Hybridge® SBA Loan was created from the demand of small business owners for a simpler, faster SBA process. If you want all the great terms and low rates of an SBA loan, but you can’t wait to get funded, then the Hybridge® SBA Loan is the right choice for you.

What Are The Benefits of NBC’s Hybridge® SBA Loan?

What Are The Benefits of NBC’s Hybridge® SBA Loan?

A Better Way to SBA

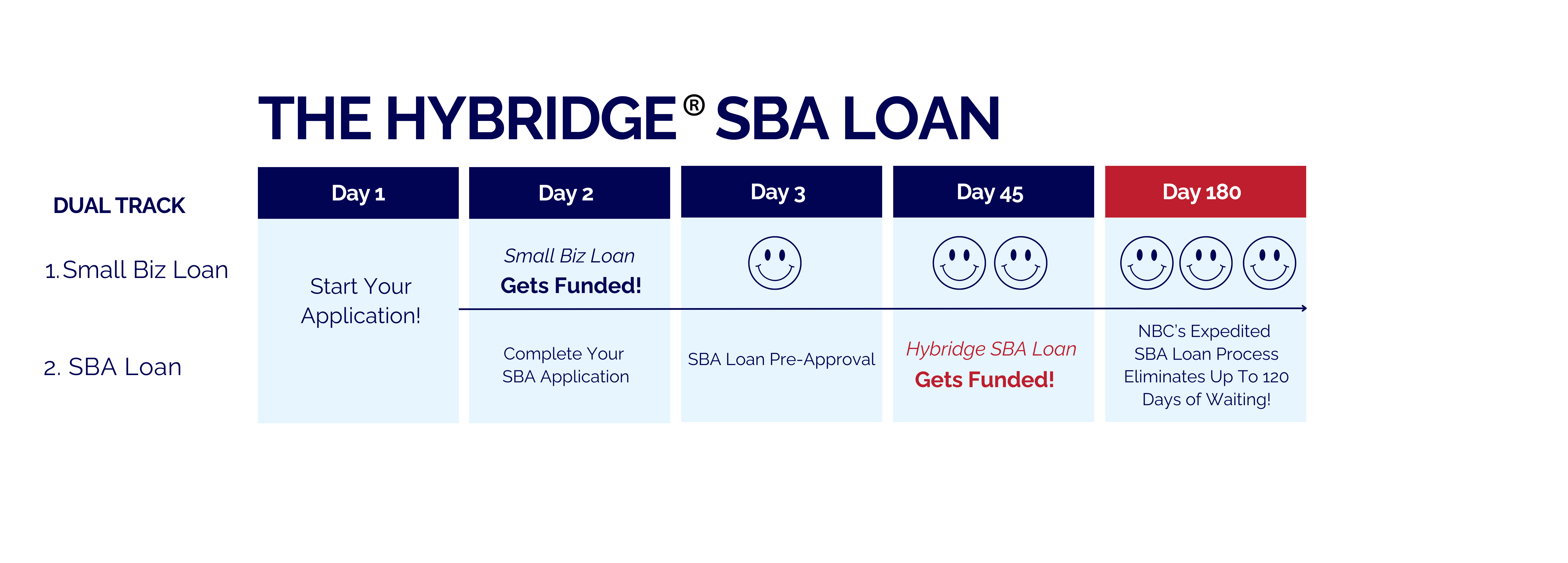

Getting an SBA loan can take forever. For those that can’t wait, the Hybridge® SBA Loan comes with access to bridge capital as soon as 24 hours after applying. These short-term funds “bridge the gap” that many business owners dread while waiting for SBA processing to complete. Instead of waiting, you can use these funds to take immediate action in taking on any business challenge or seizing any opportunity for growth.

With National’s revolutionary expedited Hybridge® SBA process, business owners can get SBA funding in as little as 45 days, instead of waiting the 6+ months, the process takes through other lenders. Once you receive SBA funding, you can pay off whatever you may have leftover from your small business loan, effectively lowering your cost of capital long term.

Immediate Bridge Capital

Get capital in as little as 24 hours to eliminate prolonged SBA wait times.

Quick, Streamlined SBA Process

Through an exclusive process, receive SBA financing in as little as 45 days.

Increased Approval Rates

Receive multiple offers through our exclusive global marketplace of 75+ lenders.

Benefits

- 90% Approval Rate

- Prime Rate+

- Expedited, Streamlined Process

- Lower Cost of Capital

The Fastest & Easiest SBA Process on the Market

The Fastest & Easiest SBA Process on the Market

Why wait for working capital if you don’t have to? Learn how you can access low SBA loan rates in just 45 days, and get immediate capital to bridge the gap!

How Can You Use Your Hybridge® SBA Loan?

How Can You Use Your Hybridge® SBA Loan?

There are no restrictions—use your capital to pursue any opportunity or overcome any challenge!

Business Growth

Buy new equipment or inventory, hire new staff, or prepare for seasonal changes.

Business Expenses

Get extra working capital to manage payroll, bridge gaps in cash flow, or pay bills.

Business Opportunities

Expand or open a second location, take on more clients, or capitalize on bulk order discounts.

Why Choose National Business Capital for a Hybridge® SBA Loan?

Why Choose National Business Capital for a Hybridge® SBA Loan?

Better Terms. Faster Funding. Easier Process.

Accelerate your success with frictionless financing and expert advice that breaks down the barriers to growth for every entrepreneur. Thrive with access to a business lending marketplace that’s built for entrepreneurs, by entrepreneurs.

Experience a time-saving machine that cuts approval times from months to hours. Leverage an extensive network of over 75 lenders and teams of expert financing advisors to ensure you’ll always have access to the capital that best

fits your business.

Working with NBC, gain a financing partner for the future, ensuring your business has the capital it needs to seize every opportunity and grow without limits.

National Business Capital. Grow to Greatness.

How It Works

You’re only a few clicks away from the capital you need to reach your full potential.

-

1.Apply Securely Within Minutes

Move through our streamlined application within minutes and upload your business documents with zero risk.

Apply Now -

2.Review Your Offers

Compare your offers with expert advice from our team and select the best one for your specific circumstances.

-

3.Get Funded

With your money in hand, you can take advantage of opportunities and tackle challenges with confidence.

10 Reasons Why National Business Capital Offers the Best Small Business Financing

| Bank | Direct Lenders | ||

|---|---|---|---|

Paperwork |

| Bank

| Direct Lenders

|

Application |

| Bank

| Direct Lenders

|

Number of Lenders | 75+ | Bank 1 | Direct Lenders 1 |

Service Level | Personal Advisor | Bank Processor | Direct Lenders Programmatic |

Approval Process | Hours/Days | Bank Weeks/Months | Direct Lenders Days/Weeks |

Speed to Funding | Hours/Days | Bank Months | Direct Lenders Days/Weeks |

Collateral Requirements | Not Necessary | Bank Always | Direct Lenders Sometimes Required |

Business Profitability | Not Necessary | Bank Last 2 Years | Direct Lenders Sometimes Required |

Credit Score | No Minimum FICO | Bank 680+ FICO | Direct Lenders 600+ FICO |

Credit Check | Soft Pull | Bank Hard Pull | Direct Lenders Hard Pull |

Hear From Our Clients

2,000+ 5-star reviews, all from satisfied entrepreneurs

Ready to See Your Options?

Go from application to approval in hours, not months, with a streamlined process that merges high-tech with human-touch for high-efficiency financing.