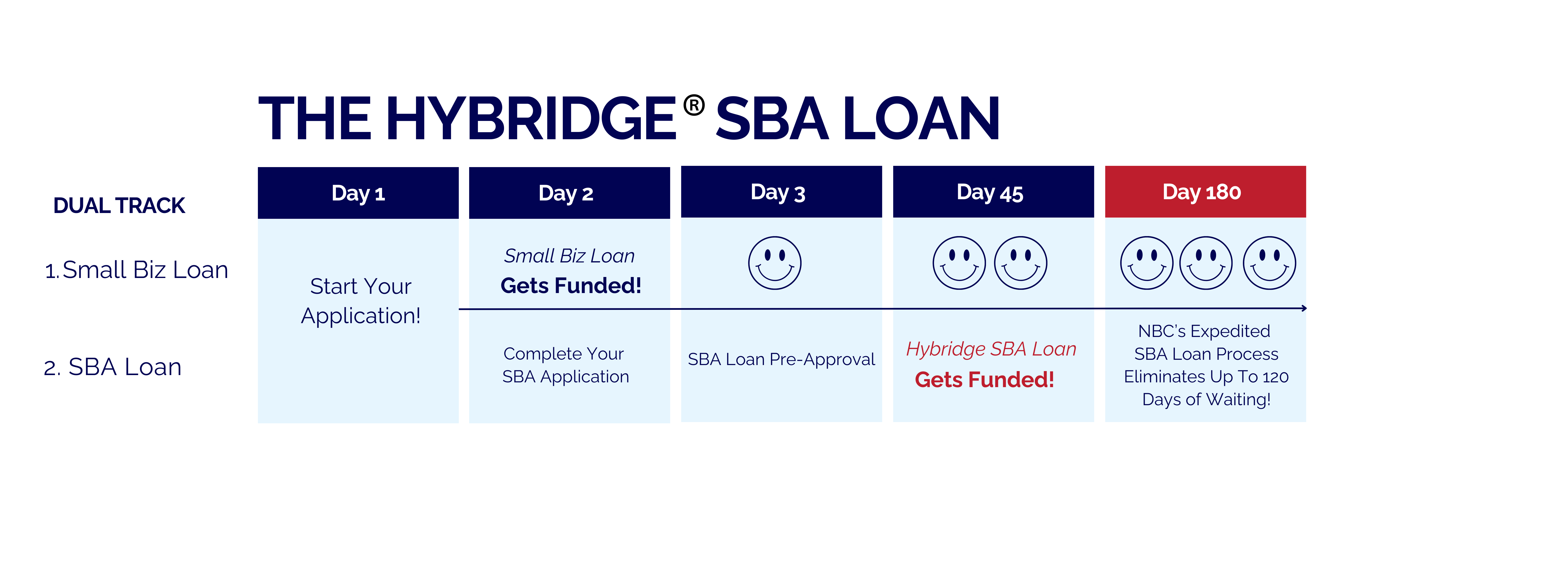

On June 15th, National Business Capital released the Hybridge SBA Loan™: the easiest and fastest way to receive the funding you need, with the speed of a small business loan, and the desirable rates offered by SBA funding. However, those are just a few of the many benefits clients receive when obtaining a Hybridge SBA Loan. You love all the benefits that regular SBA loans have to offer. Through a revolutionary new SBA funding process, NBC can secure business owners with funding in as little as 24 hours, which they can use to “bridge” the funding gap until receiving their SBA funds in as little as 3-4 weeks, instead of the 6+ months taken by banks on average!

But how do we do it? Read on to find out!

5 Reasons Why You Need a Hybridge™ SBA Loan

- Larger Offers, Lower Rates, & Longer Terms:

Most banks and other conventional lenders give their clients only one single offer, which they can take or leave with little to no chance of negotiation or counter-offers. This can leave business owners feeling helpless in getting the financing they need with terms that match their business needs.

Through NBC, business owners are connected to a vast marketplace of over 75+ lenders, who compete to give them Hybridge SBA Loan offers with the largest amounts, lowest rates, and longest terms available. - Higher Approval Rate

NBC’s streamlined and expedited SBA funding process does not only ensure a faster delivery of funds, but a much higher chance of approval as well. While getting approved for an SBA loan can be tough, National Business Capital makes it significantly easier with an approval process that focuses less on credit and financial history, and more on the value of a small business as a whole.Over many years of experience with the SBA funding process, and their relationships with many of the leading SBA lenders, the Business Financing Advisors at NBC have learned what it takes to get their clients approved easier and faster for SBA funding than any other lender, which accounts for their approval rating of 90%, compared to the bank’s SBA approval rating of about 48%. - Fund Your Goals Immediately

If you’re seeking funds from an SBA loan because of its appealing terms, but also wish to act immediately in overcoming a business challenge, or grasping an opportunity for growing your business, getting a standard SBA loan might be a terrible financial decision. The lengthy funding process taken by traditional lenders leaves many business owners without funds for much longer than expected, which can defeat the whole point of seeking funds in the first place.With NBC’s Hybridge SBA Loan, business owners receive access to the funds they need from a small business loan in as little as 24-48 hours which they can immediately use to grow their company in any way they see fit, tackle any financial issues head-on, or for virtually any other business use. - Faster Processing:

Unlike traditional lenders, who have to abide by a long and complex list of procedures in order to secure SBA loans for their clients, National Business Capital has the relationships with specialized SBA lenders needed to get the job done in nearly half the time, and with half as much effort required on behalf of their clients.NBC’s direct connections to many of the top SBA lenders in the US gives them the ability to process their clients’ SBA applications in as little as 3-4 weeks, compared to the months of waiting you’d spend for banks to finish processing.

- Minimized Paperwork:

Banks and other lenders require vast amounts of paperwork to be prepared and completed throughout the SBA funding process. Many business owners spend vast amounts of valuable time trying to figure out the process themselves, with little direction or guidance, leading to processing problems and delays to the funding process.At NBC, clients have all their paperwork and documents perfectly prepared and packaged by an experienced team of Business Financing Advisors, saving them vast amounts of time, money and resources, and speeding up the funding process. Instead of outsourcing the entire process as most banks and other lenders do, National Business Capital has an internal underwriting process that manages the entire process in-house.

Fast Alternative Financing Options Boost Business

By the time a traditional lender approves your application and secures SBA funding, you could miss out on the chance to invest in important business opportunities. With the bridge funding from National’s Hybridge option, you can start reaping the benefits of an SBA loan almost immediately. You don’t have to lose sales due to inventory running low, or pass on great limited-time equipment markdowns because you don’t have enough cash on hand.

Bridge funding also allows you to make strategic choices for your business before short-term opportunities pass you by. Whether it’s the chance to push into a new market with a timely product launch, increase your customer base through a fresh seasonal marketing campaign or snag a fantastic spot for a second location, a Hybridge SBATM loan can put an end to business FOMO.

Get the Benefits of Short- and Long-Term Funding

When you look at the options available from alternative lenders, you can generally apply for a short- or long-term loan, but not both at once. A Hybridge SBATM loan gives you the best of each type of financing by providing the quick funding characteristic of short-term loans with the rates and prepayment period of long-term financing. Bridge capital arrives in your account in one to three days, and the full amount of your SBA loan becomes available in 45 to 60 days. There’s no long wait time to get the cash you need for your business, and you have 10 to 25 years to pay off the loan in full.

Apply for Your Hybridge™ SBA Loan Today!

Fill out this 1-page, 1-minute application online, or call (877) 482-3008 to see what all the fuss is about, and learn more about how the Hybridge SBA™ Loan is revolutionizing the way small business owners finance their dreams!